Gold bars, often referred to as bullion, represent one of the most traditional and secure forms of gold investment. Unlike coins, gold bars are primarily valued for their gold content rather than any numismatic or collectible value. They come in a variety of shapes, sizes, and weights, each tailored to different investment needs and preferences.

The Basics of Gold Bars:

Gold bars are simply refined gold that has been cast or minted into a specific shape and size. The purity, weight, and often the manufacturer’s mark are stamped on each bar, ensuring its authenticity and value. Most gold bars are produced with a purity of 99.9% (24 karats), making them nearly pure gold.

Common Shapes of Gold Bars:

Gold bars come in two primary shapes, each produced by different manufacturing processes:

Cast Bars (Ingot Bars):

- Cast bars are created by pouring molten gold into molds, allowing it to cool and solidify. These bars have a slightly rough, uneven surface and rounded edges, giving them a more traditional and rustic appearance. Cast bars often carry visible marks or textures from the mold, which can vary from one bar to another. They are popular among investors for their straightforward production process and often lower premiums over the spot price of gold.

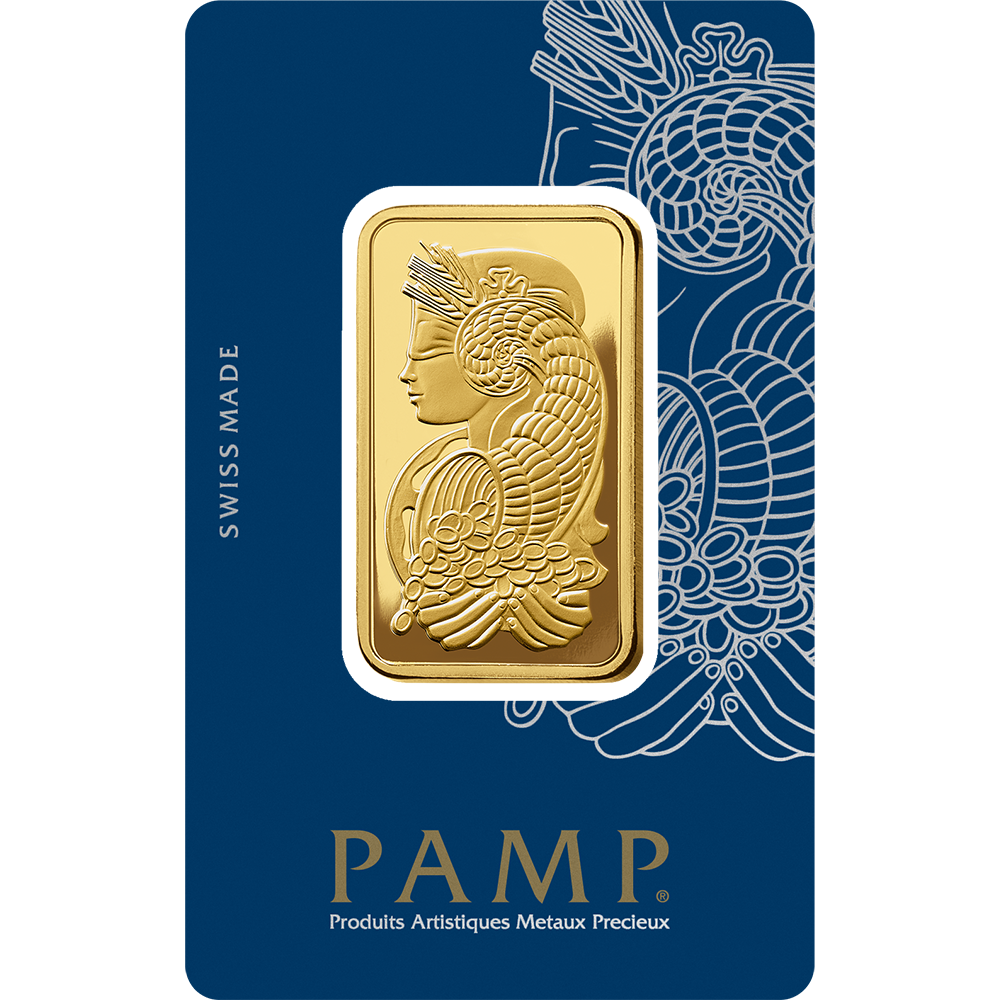

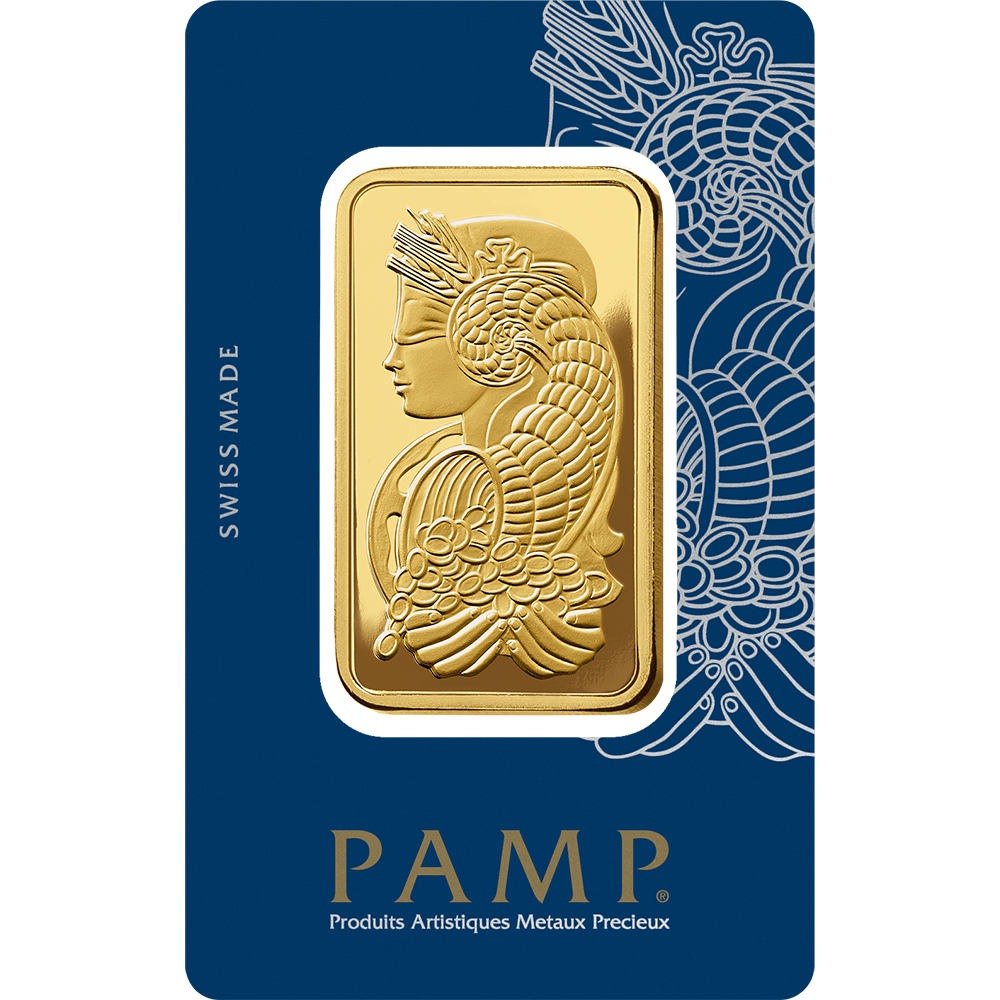

Minted Bars:

- Minted bars are produced by cutting or stamping gold blanks from a large sheet of gold. These bars have a more refined and uniform appearance, with sharp edges, a smooth surface, and often intricate designs or logos engraved on them. Minted bars are generally more expensive than cast bars due to the additional processes involved in their production. They are often chosen by investors who value aesthetic appeal as well as the intrinsic value of the gold.

Weights of Gold Bars:

Gold bars are available in a wide range of weights, catering to both small-scale and large-scale investors. Here are some of the most common weights:

1 Gram:

- The smallest standard gold bar, weighing just 1 gram, is an accessible option for new investors or those looking to give gold as a gift. Despite its small size, a 1-gram bar is still a valuable piece of gold and is easy to trade or sell.

5 Grams and 10 Grams:

- These small bars are popular among individual investors due to their affordability and ease of storage. They provide a way to gradually accumulate gold over time.

1 Ounce (31.1 Grams):

- The 1-ounce gold bar is one of the most popular choices for investors. It offers a good balance between price and portability, making it easy to store, transport, and sell when needed.

50 Grams and 100 Grams:

- These medium-sized bars are ideal for investors looking to hold a significant amount of gold without dealing with the bulkiness of larger bars. They are also easier to liquidate compared to heavier bars.

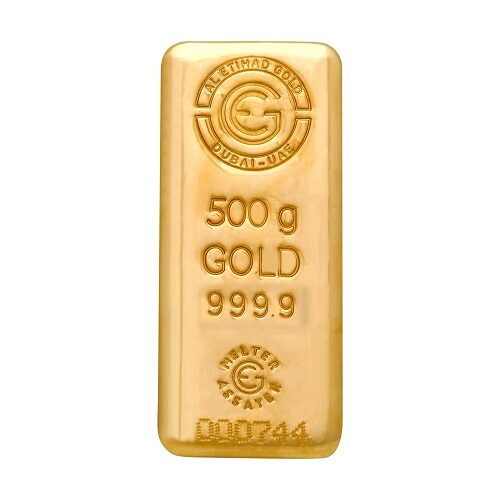

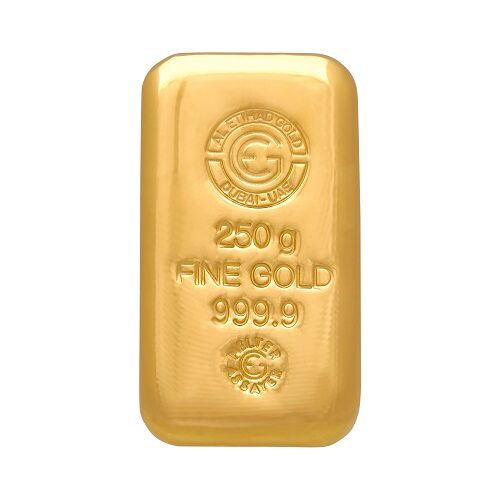

250 Grams and 500 Grams:

- These bars are larger and cater to more serious investors who wish to hold substantial amounts of gold. While they require more capital upfront, they typically offer lower premiums per gram of gold compared to smaller bars.

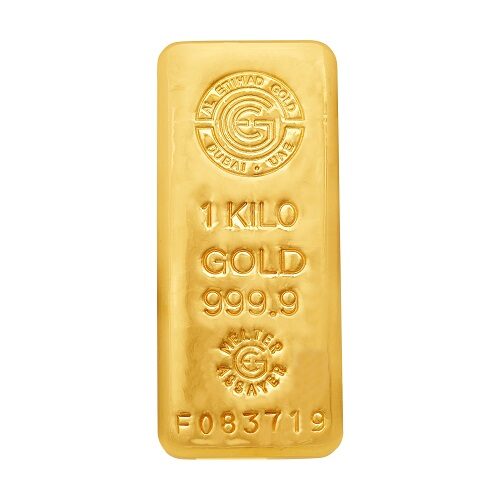

1 Kilogram (1000 Grams):

- The 1-kilogram gold bar is a standard weight for large-scale investors and institutional buyers. These bars are substantial in size and offer one of the lowest premiums per gram, making them a cost-effective way to invest in gold. However, their size can make them less liquid compared to smaller bars.

12.5 Kilograms (400 Troy Ounces):

- The 12.5-kilogram bar, also known as the “Good Delivery” bar, is the standard size used in international trade and by central banks. Weighing approximately 400 troy ounces, these bars are massive and are typically only handled by major financial institutions and large investors. Due to their size and value, they are usually stored in secure vaults and are not intended for individual investors.

Choosing the Right Gold Bar:

When selecting a gold bar, investors should consider their financial goals, storage capabilities, and liquidity needs. Smaller bars are easier to sell in small increments, while larger bars may offer lower costs per ounce of gold but can be more challenging to liquidate quickly.

Additionally, the choice between cast and minted bars depends on personal preference. Those who prioritize aesthetic appeal may prefer the sleek finish of minted bars, while others who are focused purely on value may opt for cast bars with lower premiums.

Gold bars come in various shapes and sizes, each offering unique advantages depending on an investor’s needs. Whether you’re purchasing a small 1-gram bar or a large 12.5-kilogram bar, understanding the different forms and weights of gold bars can help you make informed decisions that align with your investment strategy. As a timeless store of value, gold bars remain one of the most secure and respected forms of investment across the world.

This article provides a comprehensive overview of gold bars, covering their shapes, sizes, and weights to help investors make informed decisions.